Starting a business is tough. It’s a very brave first step to pursuing your dreams. With big dreams, however, comes even bigger challenges particularly in the beginning phases of the start up. One of the first things that an entrepreneur needs to figure out is whether or not to seek funding. There are pros and cons to getting an investor on board. A large benefit is that you get an infusion of cash. The main downside is that you have to give up a percentage of your company. In addition to giving up equity, you have to also answer to this investor (or multiple investors) and they may start to impact the decisions you make for your company.

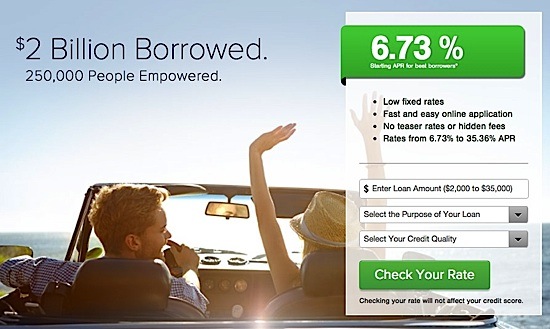

If you don’t need that much money for your business, we recommend taking out a personal loan instead. Instead of going to a traditional bank, one hugely popular place you might wanted to consider is Prosper. At Prosper, you will find available loans between $2,000 and $35,000. Interest rates vary depending on your credit history. As of this writing, Prosper advertises that you can get a personal loan for as low as 6.73% APR. If that beats your bank rate, you may want to consider looking further at Prosper.

Go to Prosper.com to learn more about how peer-to-peer lending can help your start up business. As with anything involving finances, please do your due diligence and explore all your options prior to committing.

Prosper is one of the market leaders in peer-to-peer lending. They are a popular alternative to traditional loans for the borrower. Prosper also offers investors an attractive return on their investment for those looking to participate in peer-to-peer lending as an investor.

Also, as a matter of disclosure, we do receive compensation from Prosper for profiling their company on our website. Go to Prosper.com to see if they can help you fund your business.